For this final show of 2022, Eco d’ici, Eco d’ailleurs looks back at some of the major themes of this more than eventful economic year, and gives the floor to some of our most notable guests such as American economist Jeremy Rifkin and Ivorian financier Stanislas Zeze, CEO of Bloomfield Investment Corporation.

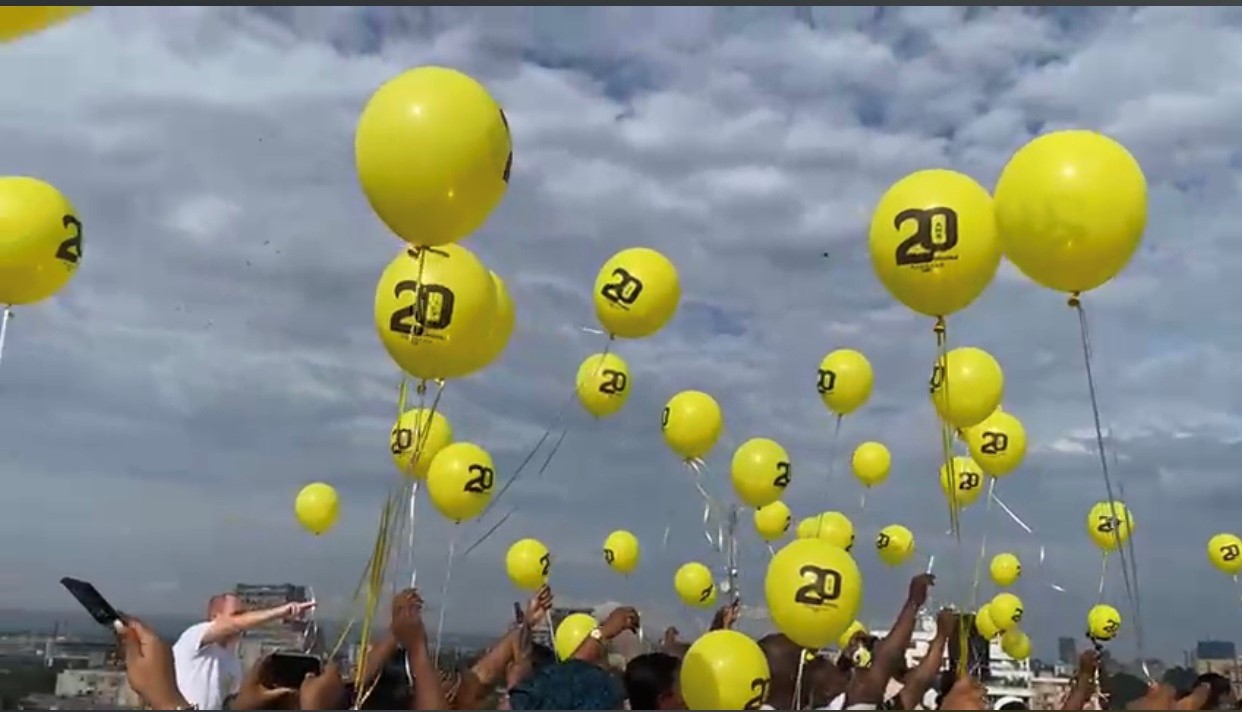

Before that, and in the first part of the show, we turn our microphone over to one of the major players in the African banking industry. Mustafa Rawji is the CEO of Rawbank, the DRC’s first private bank, founded in 2002 and headquartered in Kinshasa. This descendant of an Indian family established in Africa for over a century, details his vision of finance on the continent and the services he offers to his clients and businesses, despite the inherent difficulties in the Democratic Republic of Congo.

RFI: What are the development prospects for your bank, which is rising in the ranking of African financial champions published by Jeune Afrique magazine?

Mustafa Rawji: The development prospects are very positive currently and across several sectors of activity in the DRC. We are the largest bank in the country with a 30% market share, and we are extremely optimistic about what the future will bring.

Even if the competition with Equity, for example, is fierce.

Competition exists, and I don’t think we live in a utopian world where there will be no competition. I even welcome the arrival of different competitors in our market because I firmly believe that the more competition there is, the more the market itself expands. We are in a country with a relatively weak financial culture. The more bankers there are, the more financial culture is integrated, the more these opportunities are created.

When Western banks are thinking about leaving the African continent, do you see it as an opportunity to build African financial champions?

Absolutely, we think it’s an excellent opportunity, an opportunity to improve, innovate, and more or less replace the financial services they were used to offering in the DRC. I think we, among other banks, have this opportunity to become African financial champions.

Is this a sovereignty issue for Africans?

A sovereignty issue, no. Economic sovereignty, if you will. But I think African banks operate more or less on the same principle as Western banks. The banking profession doesn’t change depending on who owns a bank. We follow the same rules, the same philosophy. But the advantage we have is that we can better adapt to local cultures and requirements. We are closer to consumers than European or American banks.

What are your most profitable activities? Financial services for individuals, for businesses, your other activities in the energy sector, for example?

Originally, we were a bank that served large corporations. Twenty years later, we see that the axes of profitability have really changed. Today, half of our business is focused on large corporations, and the other half aims to support SMEs and consumers, retail clients, or individuals. The more the middle class grows in our market in the DRC, the more we must offer innovative services.

There is still a difficulty. Expanding financial services is more complicated in a country where the banking rate is very low, as is the internet penetration rate.

I would say that digitalization is an opportunity. Access to digital infrastructure can be a challenge, but as you will see in countries where rural infrastructure is not very well developed, telecom antennas are more easily able to serve a radius of a village or a small town. The penetration rate for mobile services is much higher than what bank branches can achieve. So the question today is: how do we create partnerships with telecom operators?

Are you doing it?

Yes, absolutely. We are in full discussion with the operators. Because financial inclusion is a topic that interests telecom operators, banks, and I would even say the government. So everyone is mobilizing their energies and bringing their strengths to the table to create a complementarity to better reach those who will need a financial service.

There is a recent study by Target which states that the majority of bank branches are located in residential neighborhoods in Kinshasa rather than in working-class neighborhoods, let alone in the countryside or rural areas.

For a bank, deploying a bank branch has a certain cost. It’s not just the rent that needs to be considered, but when the infrastructure isn’t functioning properly, you need generators, logistical resources, and security measures to take. So I think the solution will be to develop a branch network, but one that isn’t entirely managed by banks. The idea is to create a partnership with small businesses that exist in all working-class neighborhoods and create a network that offers the most basic services. Having an account, depositing money or making a small withdrawal—a fairly basic transaction on a payment terminal. The consumer will benefit because we see that bank branches in the DRC are flooded with customers. It’s absolutely essential to disperse this customer base to improve the quality of service. Banks won’t be able to build 1,000, 2,000, or 5,000 branches like those that perhaps exist in India, China, or other countries. Digital is the only way to showcase and capture or offer proper service to our customers.

To find new customers, we also need to reach out to women. You mentioned business services; female entrepreneurship also needs to be encouraged. What are you doing for them?

Female entrepreneurship is at the heart of Rawbank’s SME strategy. For 10 years, we’ve had a program called Ladies First. We’ve supported, through training or financing, around 2,500 women entrepreneurs who have now grown their businesses. As a banker, this is the kind of thing that gives you the most joy. To see someone who starts with a fairly small business and 10 years later, who has a real company. The development of SMEs is a critical focus for our bank. Our strategic objectives for 2025 include the financing of 20,000 SMEs in the DRC. And so we are in the process of deploying a fairly massive infrastructure internally. Quite intensive training, a recruitment campaign to achieve this result by December 2025.

Your bank also has very strong ties with China and has set up a specialized service for money transfers. Why launch with China in particular?

You know, Congo is a commercial melting pot, with people coming from all over the world. The mining sector is currently dominated by producers from China who produce copper and cobalt. So we have Chinese citizens who come to work in the DRC and who, perhaps, will eventually even become residents. The Visa and Mastercard product is a global electronic payment product. The equivalent in China is called Union Pay. We are the first bank in Africa to offer it under the China Express brand.

One of the big new developments at the end of 2022 is the interconnection of African financial markets. The possibility of investing more easily in other countries in the region or the continent.

We should be able to offer this service to our clients. The Congolese government is currently considering creating a stock exchange in the DRC. This would be a first. If we succeed, it would be a magnificent step forward in our environment. Companies could raise funds and offer shares in other peripheral African countries that might be interested in a stake in a company in the DRC.