The global financial crisis of 2008, combined with various economic scandals, gave rise to a very significant regulatory inflation and developed the compliance function in banking institutions and financial companies.

Knowing the scope of this function in very varied areas, thus giving rise to the overlap due to the missions it contains, the structure The Bankers Club organized a breakfast meeting punctuated by “the recent developments in the compliance function in the banking and insurance sectors in the DRC”

A good opportunity for the initiator of this structure who, in her speech, did not fail to list the major changes that this compliance function has undergone.

A conference that was marked by various interventions by professionals from banking and insurance sectors, highlighting in turn, under the admiring gaze of the audience, the significant advances in this function, from several angles.

As a major regulator, the Central Bank did not fail to outline its role in promoting the culture of compliance in the DRC, the challenges encountered in the international sphere.

Sponsor of this working dinner, Rawbank intervened during these fruitful discussions focused on the recent developments in the compliance function in the banking and insurance sectors where its Director of Compliance, Isaac Kalala, through a videoconference gave the attributes of the board of directors.

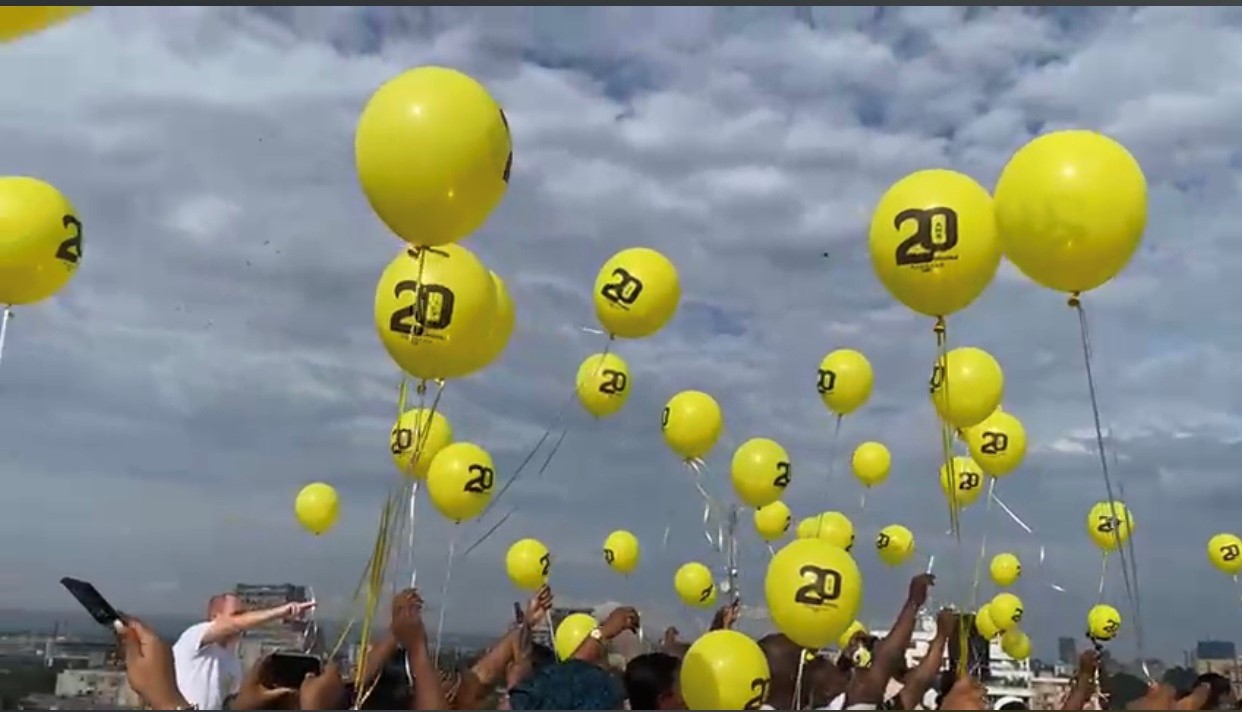

A happy ending resulting from the sharing of experience between these experts from the Banks as well as those from the insurance sector. For the president of this network, this theme has been demystified in every way. It’s a success, the result of a winning partnership with certain institutions, including Rawbank, which is celebrating its 20th anniversary.

This loyal partnership with this club is part of the mission of this banking institution, which has been campaigning for effective financial inclusion in the DRC for 20 years.

Related

Read more

- Accompaniement, Institutionnelle

Read more

- Communiqué de presse, Institutionnelle

Read more

Read more

Read more

- Action sociale, ODD 6