Kinshasa, September 28, 2022 – Rawbank, a major player in the banking sector in the Democratic Republic of Congo, and the African Guarantee Fund (AGF), a financial institution specializing in SME financing in Africa, have signed two guarantee agreements totaling $45 million, aimed at increasing Rawbank’s capacity to support SMEs and microfinance institutions.

These agreements, which benefit from the AfDB’s Initiative to Promote Women’s Access to Finance in Africa (AFAWA), follow four previous agreements signed between the two financial institutions since 2016. The strengthening of the partnership between the two institutions will enable Rawbank to further develop its financing activities for Congolese SMEs and microfinance institutions, particularly in supporting women’s entrepreneurship, one of the Bank’s priorities.

“We are delighted with the signing of this new agreement with the African Guarantee Fund, which demonstrates the continued trust placed in Rawbank by its high-level partners. This financing guarantee will be entirely dedicated to SMEs,” said Mustafa Rawji, Managing Director of Rawbank.

“Rawbank’s work with SMEs in the DRC is ambitious and well-structured. The bank provides many entrepreneurs with access to the financing they need for growth and innovation. Naturally, we have renewed our support,” said Jules Ngankam, Managing Director of the African Guarantee Fund.

Since launching its operations in 2002, Rawbank has built a network of leading international partners who have supported its efforts to promote national economic development. Over the years, Rawbank has become the leading partner of SMEs in the DRC, particularly through its Lady’s First program. To further develop their partnership, Rawbank and the African Guarantee Fund are currently working to implement a technical assistance program for credit and commercial processes.

About Rawbank

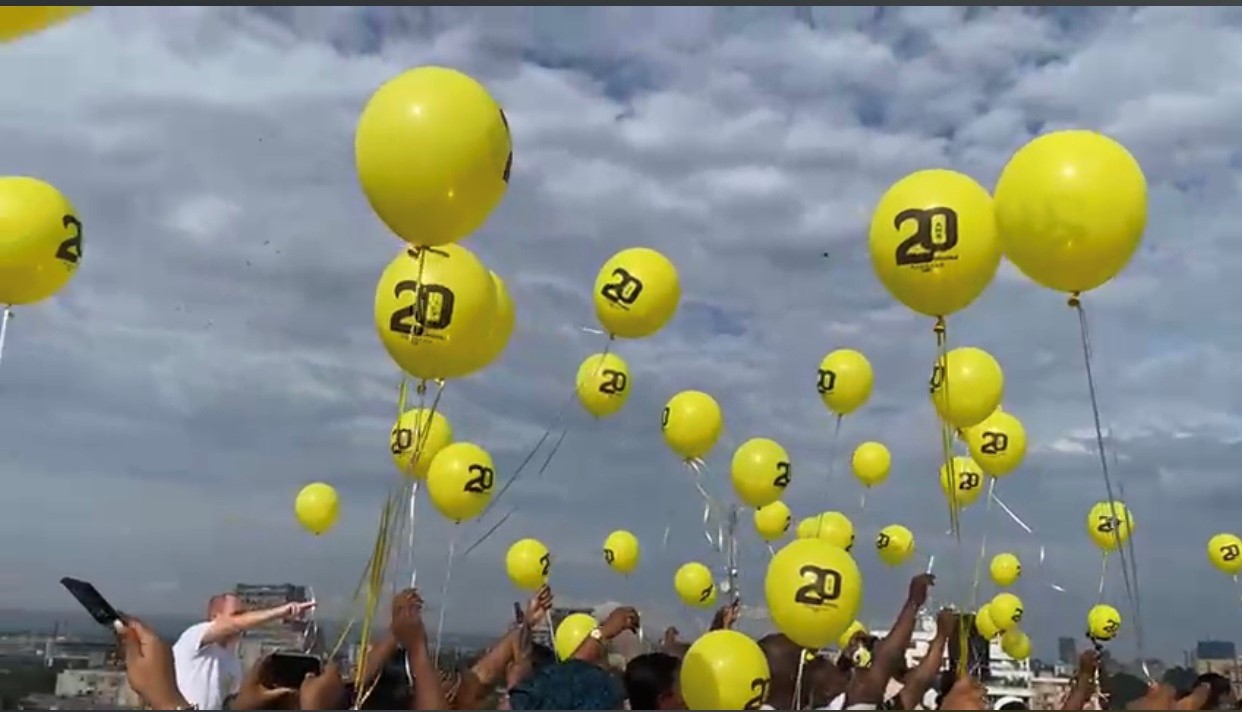

For 20 years, Rawbank has supported the development of the Congolese economy. It offers the most modern products and services to its 500,000+ corporate, SME, and individual customers through a network of 100 points of sale in 19 provinces across the country, including Greater Katanga, Greater Kasai, the two Kivus, Equateur, and Kongo Central. In addition to this extensive branch network, it also has a representative office in Brussels and 240 ATMs. With over 1,800 employees, Rawbank holds over 30% of the market share.

Strength, profitability, and sustainability are Rawbank’s priorities to consolidate its growth strategy. Its work has been recognized with the 2022 African Bankers Award for Best Regional Bank in Central Africa, a Moody’s CAA 1 rating, and ISO/IEC 20000 and ISO/IEC 27001 certifications. Partners who trust RAWBANK include: IFC, AfDB, TDB, BADEA, Shelter Africa, and AGF.

About AFRICAN GUARANTEE FUND

African Guarantee Fund is a non-bank financial institution whose objective is to promote economic development, increase job creation, and reduce poverty in Africa by providing financial institutions with guarantee solutions and capacity building support, specifically designed to support SMEs in Africa.

The African Guarantee Fund was established by the Danish government through the Danish International Development Agency (DANIDA), the Spanish government through the Spanish Agency for International Cooperation and Development (AECID), and the African Development Bank (AfDB). The other shareholders are the French Development Agency (AFD), the Nordic Development Fund (NDF), the Investment Fund for Developing Countries (IFU), and KfW Development Bank.

AGF is rated AA- by Fitch Ratings.