Rawbank has been named one of the world’s best exchange banks by Global Finance magazine. This accolade adds to the bank’s international reputation.

Rawbank has been named the best bank for exchange operations in the Democratic Republic of Congo (DRC) during the 23rd edition of the prestigious Gordon W. Platt Foreign Exchange Awards.

The criteria for this highly competitive award include transaction volume, market share, breadth of global coverage, customer service, competitive pricing, and innovative technology. Global Finance draws on the opinions of experts, including industry analysts, business executives, and technology specialists, to present its awards.

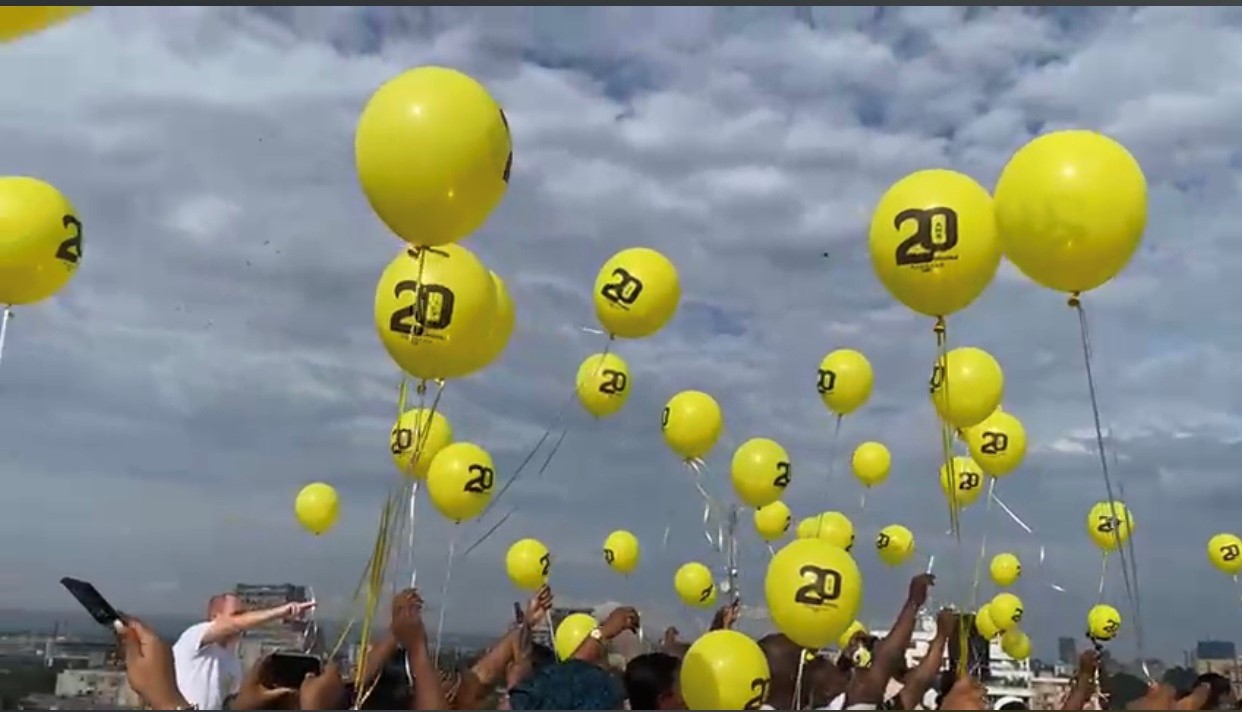

The entire industry has praised Rawbank in its twentieth anniversary year for its commitment to service, which helps finance the growth of the DRC economy. The 2022 Euromoney Award for Excellence also recognized Rawbank as the country’s best bank. And The Banker magazine named Rawbank the best bank of the year in the DRC.

This series of distinctions demonstrates the commitment and expertise of a large, talented team and the bank’s technical maturity.

Access to sophisticated exchange products is critical for these companies hoping to benefit from the DRC’s accession to the East African Community in 2022. Rawbank’s innovative services, supported by a global network of correspondent banks, contribute to Kinshasa’s position as a regional and global financial center.

Transactions are managed by the Trading Room, which offers trading in the bond and futures markets as well as access to investment funds. The Trading Room also offers products for hedging foreign exchange rates and commodity prices.

Optimus Client, a secure web-based platform, allows you to track foreign exchange declarations related to import and export transactions. This tool, for which there are no subscription fees for clients, reduces the risk of penalties for non-compliance with central bank reporting requirements.

Rawbank clients are therefore able to integrate their foreign exchange activities to create a single picture of their overall cash position thanks to Swift Light, a cash management tool that operates via a single SWIFT interface.

The bank is also the first in the DRC to receive central bank approval to issue negotiable debt securities. The first issue of negotiable commercial paper debt securities on the Congolese money market took place during an oversubscribed sale in November 2022.